In the ever-changing sea of the stock market, there sails a vessel named Airbnb, a beacon for those seeking both adventure and security in their investments. As a seasoned stock analyst with decades of experience, I’ve witnessed the ebbs and flows of many companies, but few have charted a course as intriguing as Airbnb. Let’s embark on a journey through the history of Airbnb stock, exploring its voyage from a novel concept to a robust player in the global travel industry.

The Rise of Airbnb Stock

Airbnb’s Humble Beginnings

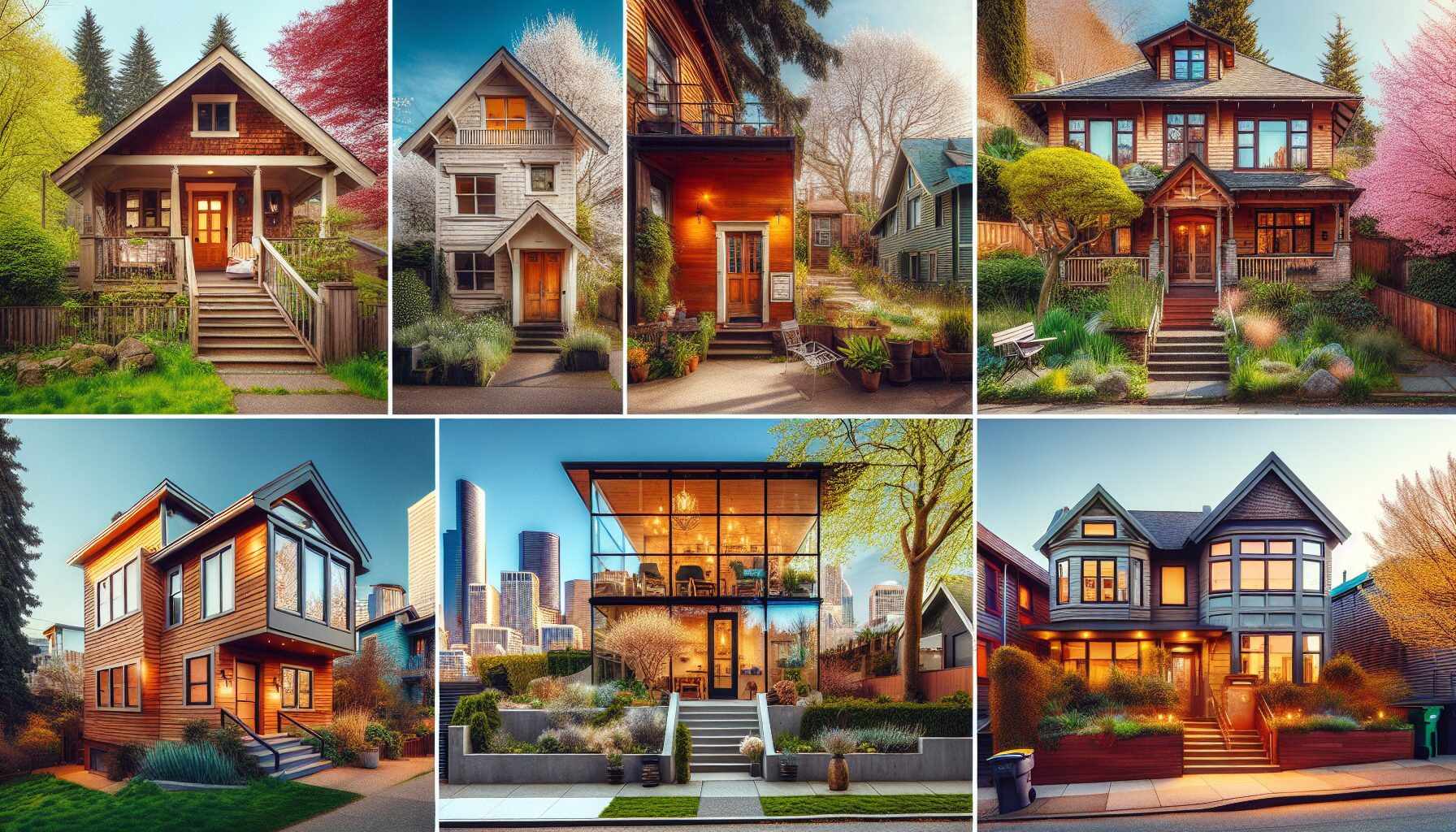

Airbnb, known for its online platform for short-term home rentals, began offering ‘home-sharing’ listings in 2008. It started as a small company in San Francisco but quickly grew into a global phenomenon, revolutionizing the travel and hospitality industry.

The IPO Milestone

In a significant leap, Airbnb went public in December 2020, with an initial public offering (IPO) price of $68 per share. On its first day of trading, the stock opened at a striking $146 per share on the Nasdaq, surging to a high of $165 before closing at $144.71. This remarkable debut pushed Airbnb’s valuation to over $100 billion, a substantial increase from its $18 billion valuation earlier that year.

Sustained Growth and Market Impact

Since its IPO, Airbnb has experienced notable growth, with a roughly 65% recovery in its stock year-to-date (as of December 2023). Despite facing macroeconomic challenges, the company has shown resilience, and the ongoing strength in travel demand suggests significant upside potential for the stock as we head into 2024.

Why Hold Airbnb Stock for the Long Term?

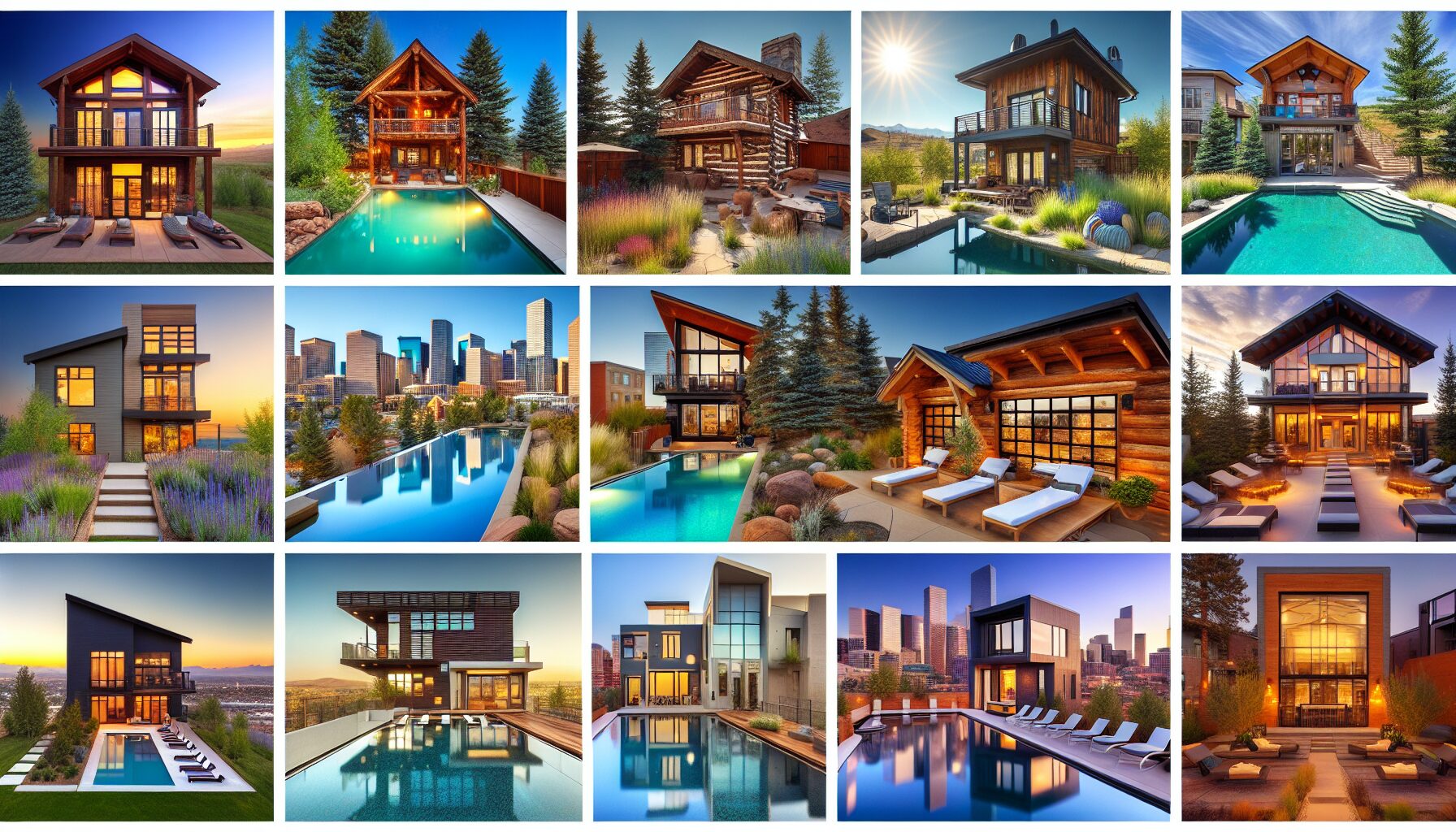

Global Expansion and Diversification

- Airbnb continues to expand globally, attracting more guests and hosts. It’s diversifying its offerings beyond just vacation stays, venturing into long-term housing solutions and unique local experiences, which contributes to its growth potential.

Rising Demand in the Travel Sector

- Despite the economic downturn, the travel industry has remained robust. Airbnb has capitalized on this trend, benefiting from increased consumer demand and the shift towards alternative lodging options over traditional hotels.

Strategic Business Moves

- Airbnb has made strategic decisions, including laying off about 20% of its staff during the pandemic to streamline operations. These moves have significantly enhanced its profitability, positioning the company for sustained success in the competitive hospitality market.

Conclusion: A Voyage Worth Embarking On

In the grand narrative of stocks, Airbnb stands out as a story of innovation, resilience, and growth. Its journey from a disruptive startup to a significant player in the stock market mirrors the ever-evolving travel industry. As a veteran stock picker, my advice to investors is clear: consider Airbnb a worthy long-term investment. Its ongoing expansion, coupled with the relentless growth of the travel sector, makes Airbnb stock a promising addition to any portfolio, potentially charting a course to prosperous horizons.